2024/1/1起,FinCEN要求申报受益所有人

最近FinCEN发布的最新关于报告有关受益人的规定引起了广泛关注。 新规要求 从2024年一月一日开始,许多在美国注册成立或开展业务的实体将被要求向FinCEN报告有关其受益所有人——最终拥有或控制公司的个人——的信息。根据2020年反洗钱法案的一部分——公司透明法(CTA),FinCEN于2022年9月发布了要求报告受益所有权信息的规定。根据这项规定,2024年成立或注册的公司,从他们获知自己成立或注册生效之日起,将有90天的期限提交初次报告给FinCEN。这项规定旨在加大力度阻止不良行为者通过壳公司或其他不透明所有权结构隐藏或从其不正当收益中获利。 报告截止时间 1.如果报告公司是在2024年1月1日之前创建或注册,则需在2025年1月1日之前提交初始受益所有权信息报告。 2.如果报告公司是在2024年1月1日至2025年1月1日之间创建或注册,则在收到公司创建或注册的通知后的90个日历日内提交初始BOI报告。这90个日历日的期限从公司实际收到其创建或注册生效的通知之时开始计算,或者在州务卿或类似机构首次公告其创建或注册之后开始计算,以先到者为准。 3.如果报告公司是在2025年1月1日之后创建或注册,则在收到公司创建或注册生效的实际或公开通知后的30个日历日内向FinCEN提交其初始BOI报告。 向FinCEN提交受益所有权信息报告是免费的,FinCEN不会收取任何费用。 申报将通过FinCEN网站提供的安全文件提交系统以电子方式进行报告。申报无需律师或注册会计师,公司都可以根据FinCEN发布的指南自行向FinCEN提交受益所有权信息。对于需要帮助履行报告义务的公司,可以咨询律师或会计。 如果公司向 FinCEN 提交的报告中包含不准确的信息,并在原报告截止日期后 90 天内自愿提交更正信息的报告,则根据《 公司透明度法案》将免于处罚。但是,如果公司不向 FinCEN 报告完整的或更新的受益所有权信息,或故意提供或试图提供虚假或欺诈性的受益所有权信息,FinCEN 会做出处罚。 故意不向 FinCEN 报告完整的或更新的有益所有权信息,或故意提供或试图提供虚假或欺 诈性的有益所有权信息可能导致民事或刑事处罚,包括违规行为持续的每一天最高 $500 的民事处罚,或刑事处罚,包括最高两年的监禁和/或最高 $10,000 的罚款。未提交所需 BOI 报 告的实体高级管理人员可能对该行为负责。 具体信息可参考FinCEN发布的指南以及Q&A:https://www.fincen.gov/sites/default/files/shared/BOI_Small_Compliance_Guide-en_us-zhs_hans_September_508C.pdf

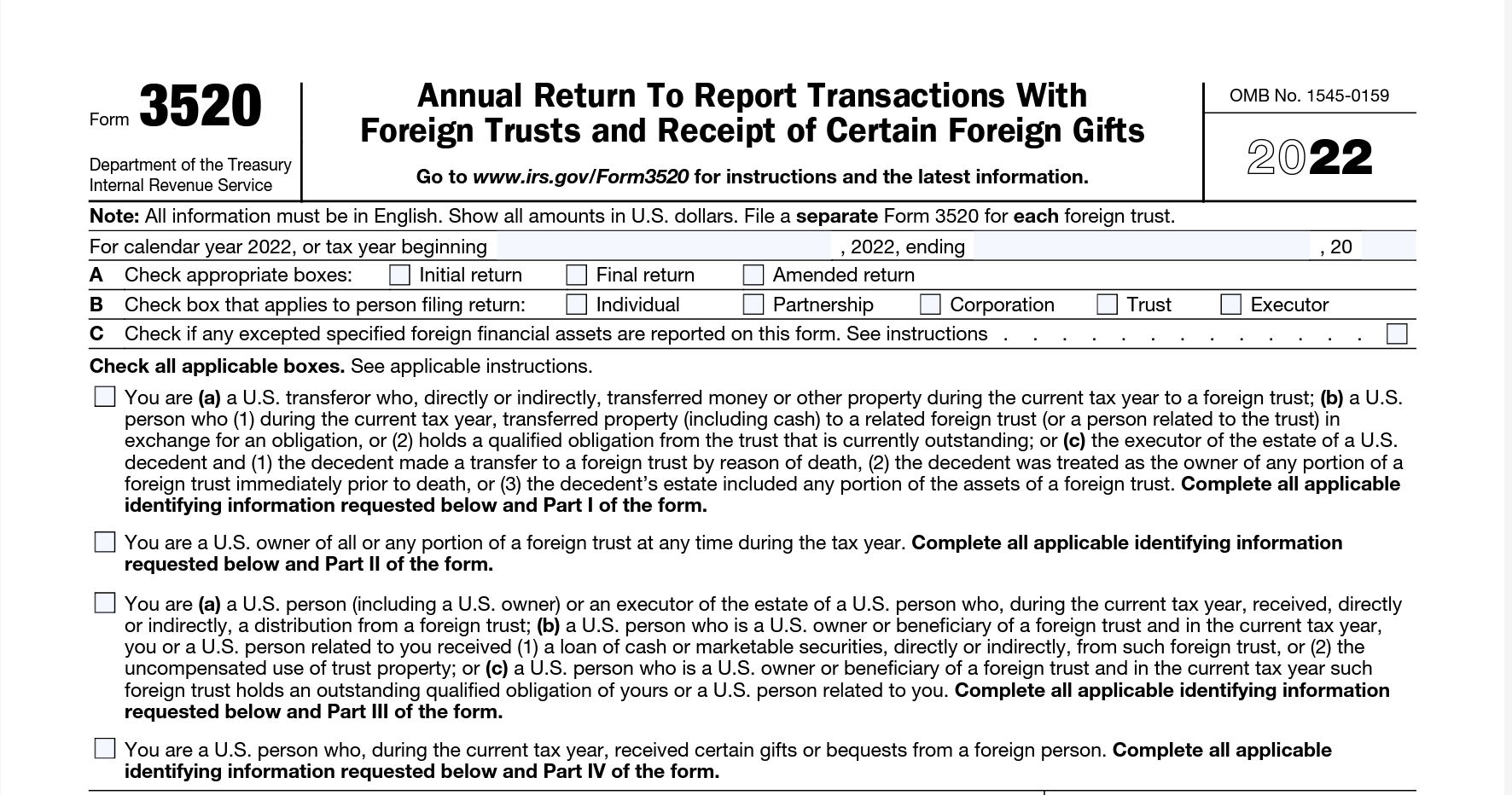

及时申报美国境外汇款,避免IRS巨额罚款

最近有朋友因为买房需求接受国内家人以赠予形式的汇款,但因为错误申报以及最终错过更正时间,被IRS罚款近$40W美金。那么如何正确申报以避免巨额罚款呢? 在2022年,如果接受汇款达到$10W, 需在2023年4月15日前申报。接受以赠予形式的汇款不需要缴税,但如果没有及时申报或错误申报将会面临巨额罚款。 罚款金额 如果您的 3520 表迟交、不完整或不正确,美国国税局可能会根据您收到的外国赠与或遗赠的来计算罚款。 对于未报告的境外赠与或遗赠,您可能会被处以每个月赠与或遗赠价值 5% 但不超过赠与的 25%的罚款。比如,在2022年,您获得$12W境外赠予且未及时申报,您面临的罚款可能高达$3W美金. 如何正确申报呢? 1. 申报需填写Form 3520 2. 从境外个人或信托(如父母,亲戚)获得累计受赠额如果超过$100,000 则必须申报,申报时需列出每一笔超过$5,000的受赠。 3. 从境外公司获得累计受赠额如果超过$16,815(2021年计) 则必须申报,申报时需列出每一笔赠予的赠予者以及赠予额。 4. 通常申报的截止日期在下一年的4月15日之前。如果年终报税延期,那么截止日期则延至10月15日之前。 比如,2022的受赠需在2023年4月15之前申报,如果2022的报税延期,那么2022的受赠也可延期至2023年10月15日之前申报。 基于大家的问题的补充: 1.如果是自己本人在不同国家的账户之间的汇款转帐,需要申报吗? IRS的本条规定适用于US person接受美境外其他个人或公司资产的情况,不针对自己本人所有的普通银行账户的转账(美境外信托除外,此处暂不讨论)。 2.这个规定适用于那些人? US person – citizen,resident alien,公司,在美信托,遗产 3.如果数额$9.9w或者$10w是否需要申报? IRS规定超过$10W申报,但不建议在边缘尝试。 4.$10W限额是同一个人还是不同人的累计? IRS的rule规定是从同一个境外人或某一处遗产获得各自累计超过$10W的赠予或遗赠时申报。比如在2022年国内父亲给$10w, 母亲给$10w, 亲戚给$10w, 理论上是 不需要申报。(信托情况除外,暂不讨论) 5.夫妻共同获得超过$10w境外赠予是否需要申报? a.共同申报并勾选Form 3520 的page 1 line1 b.从同一个人处获得则申报。从不同人处获得,且不同人的各自累计不超过$10w则不需要。

Additional New York State Child and Earned Income Tax Payments!

The 2022–2023 New York State budget provides for one-time checks to eligible taxpayers for two separate payments: •one based on the Empire State child credit, and •one based on the earned income credit (or noncustodial parent earned income credit). If you qualify for a payment for one or both credits, you don’t need to do […]

NYC News – File Your Taxes with NYC Free Tax Prep

NEW! If you were eligible for the New York State Earned Income Tax Credit (EITC) or the Empire State Child Tax Credit in tax year 2021, you may receive the Additional New York State Child and Earned Income Tax Payment this fall. GetCTC Portal Relaunched! If you earned less than $25,100 filing jointly, less than […]

Reliable Small Business Accountant

美国赠与税基础知识

如果您向亲戚或朋友赠送了足够大的赠与,您可能需要缴纳联邦赠与税。以下是赠与税如何运作的基础知识。 联邦赠与税是赠与者而非受赠者必须缴纳的税款。除非您在一生中捐赠了超过 1170 万美元(2021 年新的终身免税额)现金或其他资产,否则您不会欠税。如果您已婚,您可以选择与您的配偶分拆赠与。 年度联邦赠与税豁免允许您在 2021 年向每个人捐赠最多 15,000 美元,而这些赠与不计入您 1170 万美元的赠与终身免税额。 2022 年的年度免税额提高到 16,000 美元。如果您在 2021 年赠与超过 15,000 美元,即使您因为 1170 万美元的终身免税额而没有欠任何赠与税,您也必须向 IRS 提交 709 表格。 IRS 表格 709 用以申报可能需要缴纳联邦赠与税和某些跨代转让税的资产转让。 例如,如果您在 2021 年给两个亲戚每人 20,000 美元,并给另一个亲戚 10,000 美元。 20,000 美元的赠与被称为应税赠与,因为它们超过了每年 15,000 美元的免税额。但是,除非您用尽终身免税额,否则您不会欠任何赠与税。 • 假设您没有用尽终身免税额,这两项应税赠与只会将您的终生免税额减少 10,000 美元 ($20,000 – $15,000) x 2 = $10,000。 • 另一笔 10,000 […]

The Basics about Gift Tax

If you made large enough gifts to relatives or friends, you might owe the federal gift tax. Here are the basics on how the gift tax works. Federal gift tax is that gift giver, not gift recipients, must pay it. You won’t owe the tax until you’ve given away more than $11.7 million (new lifetime […]

We are founded!

On December 30, 2020, LINS Accounting & Advisory, LLC was founded. Aiming to provide high quality accounting services to startups, small businesses and individuals, the founder has approximately seven years experience working in public accounting firms and worked with hedge funds, assets management companies, public and private community banks. The founder is a public registered […]