The 2022–2023 New York State budget provides for one-time checks to eligible taxpayers for two separate payments:

•one based on the Empire State child credit, and

•one based on the earned income credit (or noncustodial parent earned income credit).

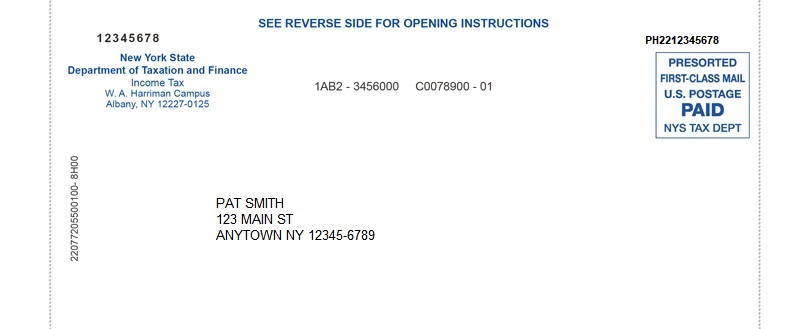

If you qualify for a payment for one or both credits, you don’t need to do anything; NY State will automatically calculate and send you one check that will include the total amount you’re entitled to.

NY State begins to mail these checks in October 2022.

You are entitled to a payment if, for tax year 2021, you received at least $100 for either or both of the following credits from New York State:

1. an empire state child credit

2. a New York state earned income credit (nor noncustodial parent earned income credit)

3. You must also have filed your New York State income tax return (Form IT-201) by April 18, 2022, or had a valid

extension of time to file.

NY State starts mailing checks in October, and NY State will issue most payments by October 31, 2022.

Your check amount will be based on your 2021 Empire State child credit, your New York State earned income credit (or noncustodial parent earned income credit), or both.

The payment for the Empire State child credit is anywhere from 25% to 100% of the amount of the credit you received for 2021. The percentage depends on your income.

The payment for the earned income credit (or noncustodial parent earned income credit) is 25% of the amount of the credit you received for 2021.

If you qualify to receive a check for:

•only one payment, your check is equal to that payment amount; or

•both payments, add together your payment amounts to determine your check amount.

Note: If you received at least $100 for either credit, your check will include a payment based on that credit. For example, if your 2021 New York State earned income credit amount was $80, and your Empire State child credit was $200, your check will only include the payment for the Empire State child credit.